Table Of Content

A house deed is a written document that shows who owns a particular property. When someone is ready to buy a house, the buyer and seller must sign a deed in order to transfer the property’s ownership rights to the new homeowner. When a home is sold, the grantor must provide the house deed to the grantee, who will likely conduct a title search to be absolutely certain the property has no liens on it.

Special Warranty Deeds

If they didn’t leave a will, an administrator’s deed could be used depending on local laws. To request a copy of the deed, you’ll need some basic information such as information about the owner, the property parcel number, the address, and the property description. Note that the owner may be the mortgage lender until the mortgage is fully paid. Chain of title represents the complete and unbroken ownership of a property. Learn more about chains of title in real estate and why they’re important here.

Legal

In such situations, the seller or grantor usually has limited or no knowledge of the property’s history or status. A bargain and sale deed includes a warranty that the grantor owns the property but doesn’t guarantee against claims or liens. It does not protect the grantee against title-related problems that may arise after the transfer. The grantee assumes the risk of any encumbrances or defects in the title. Certain essential elements must be contained within the deed for it to be legally operative.

Make sure house deeds are a part of your estate plan

An heir to the former couch owner likely isn’t going to contact you down the road saying that they actually are the rightful owners of said couch, creating problems for you as the new couch owner. When you buy a brand new couch from the furniture store, you don’t have to worry about who owned that couch in the past and if there are any outstanding debts or claims against it. You pay for the piece of furniture, take a receipt, and now it’s yours to nap on or decorate with your favorite throw pillows. The latest real estate investing content delivered straight to your inbox.

House deed transfers are typically conducted at the time of closing and will typically be facilitated by a real estate attorney. The new deed is then filed with the county recorder’s office; this responsibility will be delegated at the time of closing. In some cases, your lender or agent will file the new deed, or your attorney may handle the responsibility. If you ever need to change the name on the deed, like after getting married or divorced, you can file a request with the county. A grant deed, used in some states, is similar to a special warranty deed. Generally, a state will use either a grant deed or a special or limited warranty deed, but not both.

Banks generally offer this type of deed when they’ve become the owner of the property through foreclosure and are now selling the property to a new owner. They can fall into a variety of different categories, and there are certain nuances to each that you may not be familiar with. This article will review what a house deed is and how it affects your property rights as a homeowner. Most issues with title (like the above) must be resolved before the seller can transfer ownership of the property to the buyer. To sum up, the legalities around property ownership and transfer are pretty complex compared to most everyday purchases, hence the need for extra layers of verification and documentation. Tricia Brost, a top-selling agent in the Milwaukee area, shares that problems can arise when more than one person has ownership rights.

No transcript, no appeal: California courts face ‘crisis’ over lack of records

Raina Chou creates data-driven articles about the most pressing legal issues in the U.S., combining legal insights with a sharp understanding of users’ needs. Deeds of trust are used in about half of the states as an alternative to a traditional mortgage. Rocket Homes Real Estate LLC is committed to ensuring digital accessibility for individuals with disabilities.

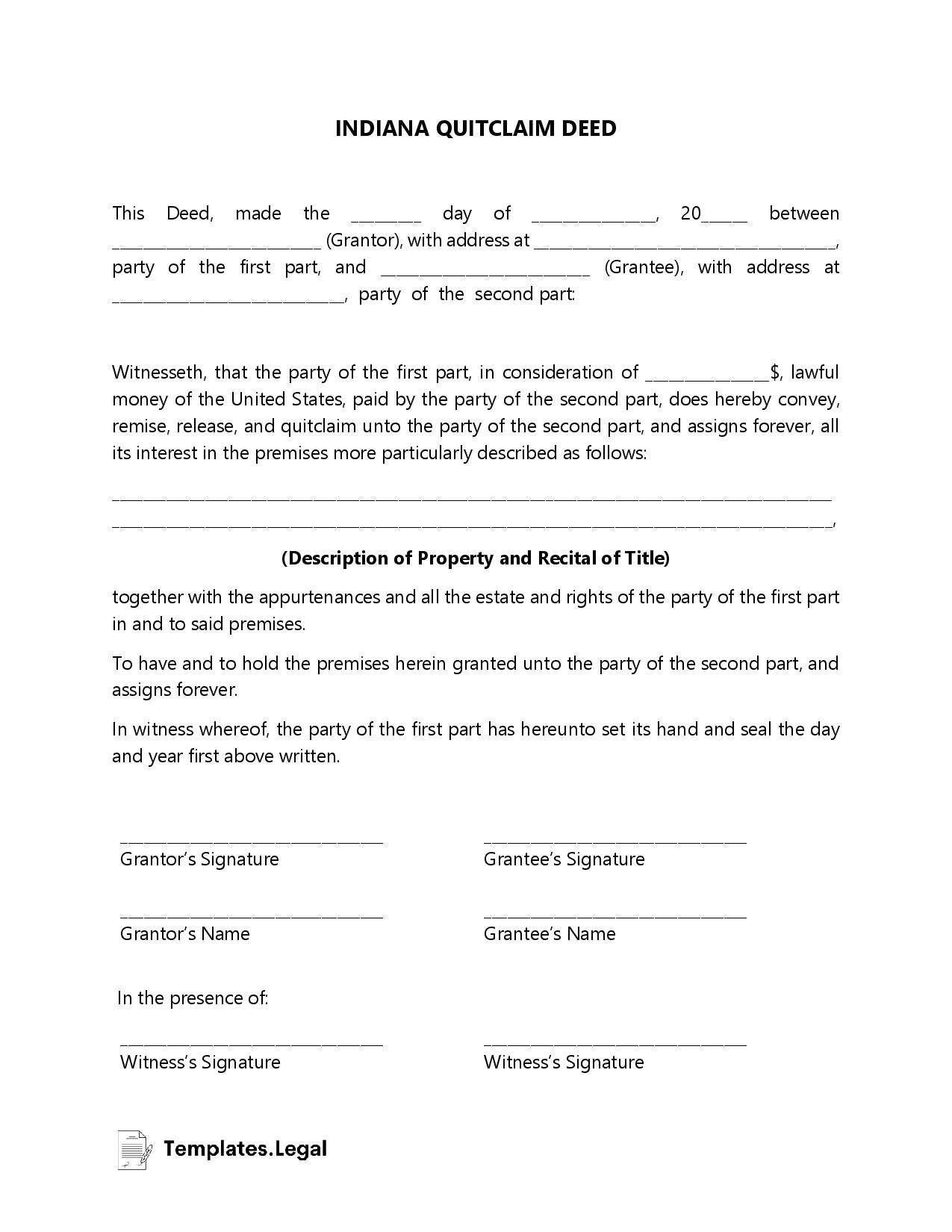

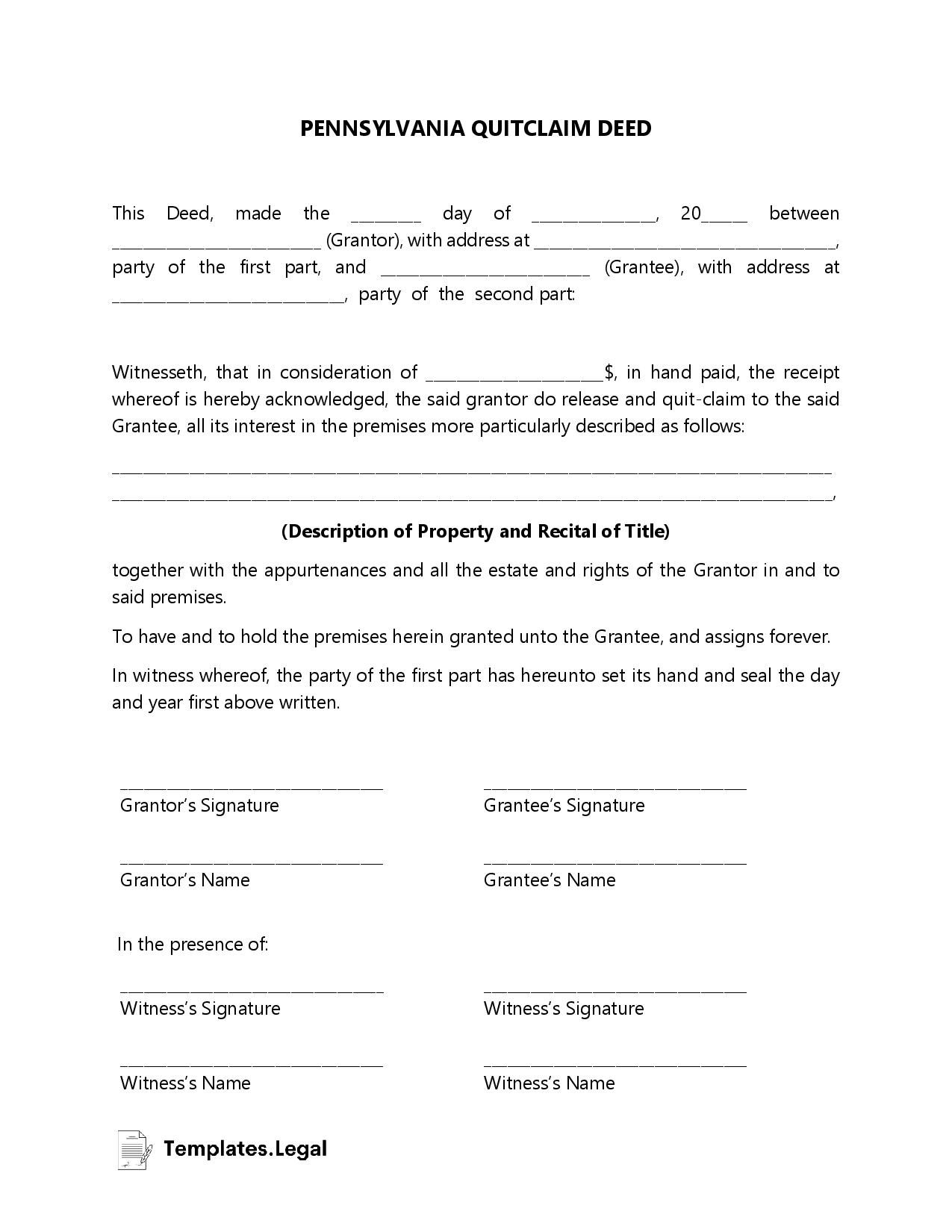

Let’s say you’re about to close on the home of your dreams only to discover your seller bought the property through a wrongful foreclosure. Or perhaps you’re loving life in your new digs when a stranger shows up at your door claiming it’s his home and that he never OK’d the sale. A top real estate agent can serve as an invaluable transaction coordinator during steps like the title search and deed transfer. There is no uniform template or format required of property deeds, so any documents that you come across may have some variations. We’re going to share some examples of what property deeds generally must include, but be sure to double-check the requirements of the specific state you live in.

Lawmakers Introduce Bill to Reform Controversial Contract-for-Deed Home Sales - ProPublica

Lawmakers Introduce Bill to Reform Controversial Contract-for-Deed Home Sales.

Posted: Thu, 01 Feb 2024 08:00:00 GMT [source]

Therefore, you wouldn’t have access to certain rights or financial tools that would otherwise be at your disposal. A deed to real property must be properly filed with the local government for its owner to be able to sell it, refinance it, or obtain a line of credit on it. This task is usually undertaken by the property buyer's attorney or title insurance company.

Making sure the property deed you have is valid where you live is the most important piece. Because of this, quitclaim deeds are seldom used when there’s a financial exchange for the property. They are often used in family matters, such as when a married person signs a quitclaim deed to convey their share of property interest to their spouse. With a general warranty deed, the grantee has a right to the property free and clear. The grantor, or the person selling or gifting the property, is guaranteeing that there are no liens or easements against the property.

A real estate title, on the other hand, refers to the legal ownership of a property and the rights that come with it. The title includes a history of all ownership changes, liens and other encumbrances that affect the property. A title search is typically conducted to verify the seller has legal ownership of the property and identify any potential issues or claims that may affect the property. Home buyers can purchase title insurance to protect against possible past title or ownership issues that occur after buying a home.